15+ 350000 mortgage

Based on a 350000 mortgage. Property value Loan balance Cash out Interest rate Loan term years.

How Much Of A Mortgage Could You Afford If You Make 35 000 A Year Quora

PMI required for down payment less than 20.

. Most prospective borrowers choose either a 15-year mortgage or a 30-year mortgage. Extra Payment Loan Types and Points. KeyBank is a.

A second gargantuan growth stock thats fully capable of turning a 350000 initial investment into a cool 1 million by the end of the decade is Berkshire Hathaway BRKA-332 BRKB-354. Given that ARM loans are variable the interest rate could end up being higher than with a 30-year fixed rate mortgage that has a locked-in mortgage rate. Rates quoted are based on a loan amount of 350000 for the stated.

Hammer released the information in response to a written request from the Star. 1 APR Annual Percentage Rate. Note that your monthly mortgage payments.

Monthly payments on a 150000 mortgage. 15 Year Fixed. A 15-year fixed rate mortgage on the other hand may offer a lower interest rate that wont fluctuate like an ARM loan but requires a higher monthly payment compared to a 30-year fixed.

Rates quoted are based on a loan amount of 350000 for the stated term. Average costs of new houses are increasing at a higher rate specifically 18 compared to existing homes. For today Friday September 16 2022 the national average 15-year fixed mortgage APR is 5590 up compared to last weeks of 5350.

There are many different mortgage products but the 30-year fixed is the most common. MORTGAGE LOAN RATES TERMS APPLICABLE TO REFINANCE TRANSACTIONS ONLY REFER TO PURCHASE RATE SHEET FOR PURCHASE RATES. Longtime Minnesota State Fair General Manager Jerry Hammer revealed publicly Wednesday that he makes 350000 a year.

JOIN ANGELO CHRISTIAN TODAYSubscribe NowExcluisve Program Real Estate University 5 Start HereAngelo Christian Join the Angelo Christian Team SALES MARKETING WORKSHOP Sign upABOUT ANGELO CHRISTIAN Angelo Christian is an investor and entrepreneur in the UnitedStatesHe is the Chairman and CEO of Christian Financial a Diversified Investment. 1946 sqft - House for sale. Agent finder Open Agent finder sub-menu.

Assuming you have a 20 down payment 70000 your total mortgage on a 350000 home would be 280000. Personally I have two mortgages right now. Some house types are experiencing more volatility than others.

56-Month ARM. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. At a 4 fixed interest rate your monthly mortgage payment on a 30-year mortgage might total 95483 a month while a 15-year term might cost a month.

Calculate your mortgage payoff date. Both selections have a marked effect on the interest rate you are offered. Estimate the cost of 30 year fixed and 15 year fixed mortgages.

9089 Durness Way Sacramento CA 95829. 350000 400000 450000 500000. Heres a breakdown of what you might face monthly in interest and over the life of a 150000 mortgage.

At a 4 fixed interest rate your monthly mortgage payment on a 30-year mortgage might total 71612 a month while a 15-year term might cost a month. Minimum down payment 3. For a 350000 home bought with a 10 percent down payment of 35000 the principal balance at the beginning of the mortgage will be 315000.

Monthly payments on a 200000 mortgage. One is a 30-yr. Heres a breakdown of what you might face monthly in interest and over the life of a 200000 mortgage.

The rates shown here assume a loan size of 350000 for a primary occupancy single family home in CA loan to value of 80 no cash out rate lock period of 45 days and a credit score of 720 or higher. The mortgage product is not offered in Puerto Rico. Home Mortgage Rates.

For example luxury home prices grew by more than 30 in three of the USs most populous cities between 2020 and 2021. Taxes Other Fees. For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 1257 monthly payment.

Mortgage learning center. Some other common mortgages are the 15-yr fixed 71 ARM adjustable rate mortgage and the 51 ARM. Can take into consideration property tax and private mortgage insurance PMI.

See School Employee Special No PMI Fixed-Rate Mortgage and No PMI Adjustable-Rate Mortgage for No PMI programs. Note that your monthly mortgage payments. Washington DC and Puerto Rico.

Disclosed APR includes 30 days of estimated prepaid interest. Use SmartAssets free Nevada mortgage loan calculator to determine your monthly payments including PMI homeowners insurance taxes interest and more. Mortgage Payment PI Mortgage Payment PI.

New constructions are typically more expensive than existing homes but the. Todays national 15-year mortgage rate trends. In my experience as a realtor almost all first-time homebuyers have opted for the 30-year fixed.

Keller Homes For Sale In Colorado Springs New Listings

/average-what-can-i-expect-my-private-mortgage-insurance-pmi-rate-be.asp-d107c689ce61440b9ccc69363bbc08c0.png)

On Average What Can I Expect My Private Mortgage Insurance Pmi Rate To Be

Property Search Central Florida Homes For Sale And Real Estate

Homes For Sale With Rv Parking Surprise Az

Loan To Value Ratio Explained Quicken Loans

:max_bytes(150000):strip_icc()/average-what-can-i-expect-my-private-mortgage-insurance-pmi-rate-be.asp-d107c689ce61440b9ccc69363bbc08c0.png)

On Average What Can I Expect My Private Mortgage Insurance Pmi Rate To Be

Mark Welti Real Estate Consultant Brookstone Realtors Linkedin

Vnp1qjyv2vnhhm

Pjlomuxe2wl8jm

How Much Of A Mortgage Could You Afford If You Make 35 000 A Year Quora

Leslie Mcintosh Wilmington Nc Real Estate Agent Realtor Com

Luiz Leonetti Town And Mountain Realty Nc Real Estate

How Much Of A Mortgage Could You Afford If You Make 35 000 A Year Quora

Cheap Houses For Sale In Cariboo Chilcotin Coast Bc Point2

Nicholas Fix Real Estate Agent Mcmurray Pa Berkshire Hathaway Homeservices

Help To Buy Htb Scheme For First Time Mortgage Buyers Pax Financial

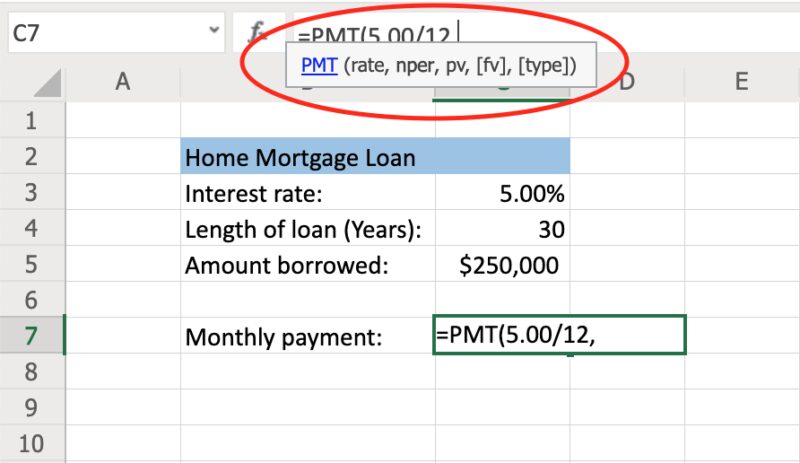

How To Calculate Monthly Loan Payments In Excel Investinganswers